Unsecured Bad Credit Loans Can Assist Rebuild Your Credit History

Created by-Figueroa Ralston

Unsecured lendings

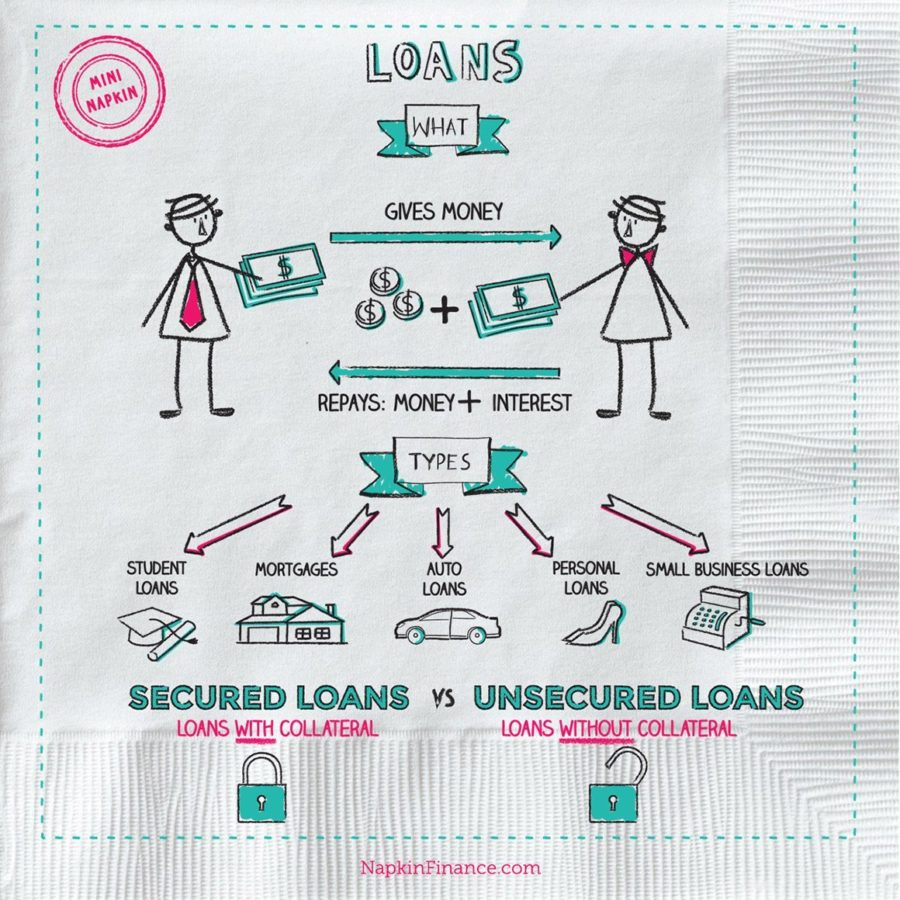

Unsecured finances are a good way to get quick accessibility to a smaller amount of cash. Unlike guaranteed finances, unsecured fundings do not require security. Nevertheless, they can be a lot more expensive and also have higher rate of interest. They can additionally be harder to receive than guaranteed financings. While they can be used for a range of purposes, it is essential to make the effort to compare the terms and conditions offered. Taking out an unsecured car loan can be an excellent method to reconstruct your credit score, yet you must ensure you do it responsibly.

Getting an unsafe car loan is reasonably simple. You can go on the internet to a lending institution's internet site as well as complete an application. The lending institution will certainly assess your information and also send a lending choice to you by means of e-mail. When authorized, you can receive the funds in your checking account the next business day. If https://www.soup.io/bad-credit-personal-loans-guaranteed-approval-of-5000 do not fulfill the repayment demands, you may be billed a late cost.

Several lenders will allow you to add a cosigner to your funding. This assists you get accepted for an unprotected loan, even if you have poor credit scores. In many cases, the cosigner consents to repay the debt with you. Other times, the cosigner will certainly just be an assurance of your ability to pay. Despite the choice you select, always pay your debts on time. Not paying your debts can be a major consider harmful your credit rating.

An unsafe financing can be a terrific way for you to settle your costs. By utilizing the loan to combine your financial debt, you can stay clear of having to pay even more in rate of interest than you would or else. These fundings can be utilized for a selection of functions, consisting of residence renovations, financial obligation loan consolidation, and tuition expenditures.

Whether you are trying to find an unsafe personal finance or an installment finance, there are several alternatives to think about. Some supply higher borrowing limits as well as shorter payment durations than others. When you look around, you will certainly intend to compare the terms and also expenses of the various types of fundings. Paying down your financial debts can help you to stay clear of needing to declare insolvency.

Unsecured financings are often much less high-risk for both the loan provider and also the borrower. However, you must still focus on the rates of interest and also origination fees of the lending you pick. Additionally, make certain you are able to fit the expense of your loan into your budget plan. Maintaining your other lendings up to day can likewise be an advantage.

Some loan providers likewise offer cash-out vehicle fundings. If you possess a car as well as have a little equity in it, you might have the ability to get a cash-out vehicle funding. Yet bear in mind, you are taking a risk by quiting your auto's value while doing so. https://www.edmunds.com/car-news/coronavirus-zero-interest-car-loans-and-deals.html of an unsafe individual loan is that you may not be able to get a larger financing quantity if you have bad credit scores.

Using a pawn store is one more alternative, yet know that you are giving up your possessions if you do not repay the lending. Additionally, if you are unable to make payments, the items you have actually pawned may be offered.